how to file back taxes without records canada

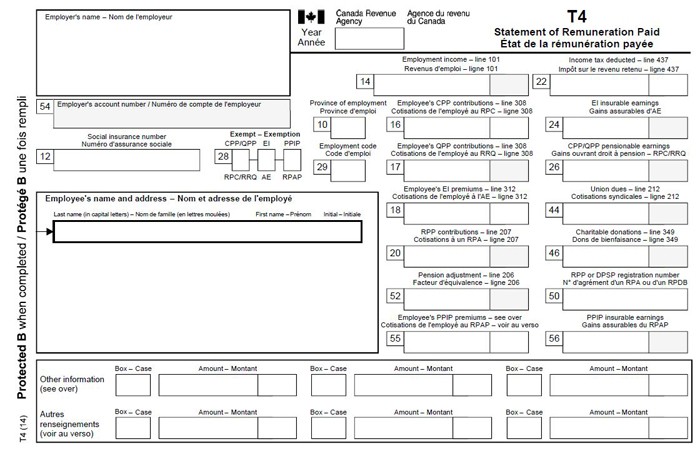

The employer deducts income tax employment insurance and other required deductions from the paycheque and a a T4 is issued annually to support the individual filing of the tax return. Whether you are late by one year five years or even ten years it is crucial that you file.

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

. As a newcomer to Canada you will need a social insurance number SIN. As an employer you must report these taxes to the Internal Revenue Service IRS. If you were a resident of Canada in a previous year and you are now a non-resident you will be considered a resident of Canada for income tax purposes when you move back to Canada and re-establish your residential ties.

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. How far back can you go to file taxes in Canada. If you live in Montana and need to file for dissolution of marriage divorce youll need to know about the law and procedures.

This isnt the file youll send to the state. For more information visit Service Canada. Aug 03 2022.

This is the file youll send to the state. If you are in a difficult financial situation its possible to get a divorce without paying a dime. Select Yes to save the Excel workbook for your records.

An employer must withhold income taxes withhold and pay Social Security and Medicare taxes and pay payroll taxes and unemployment taxes on wages paid to an employee. Learn the residency May 02 2022 6 min read. Note the file name and location.

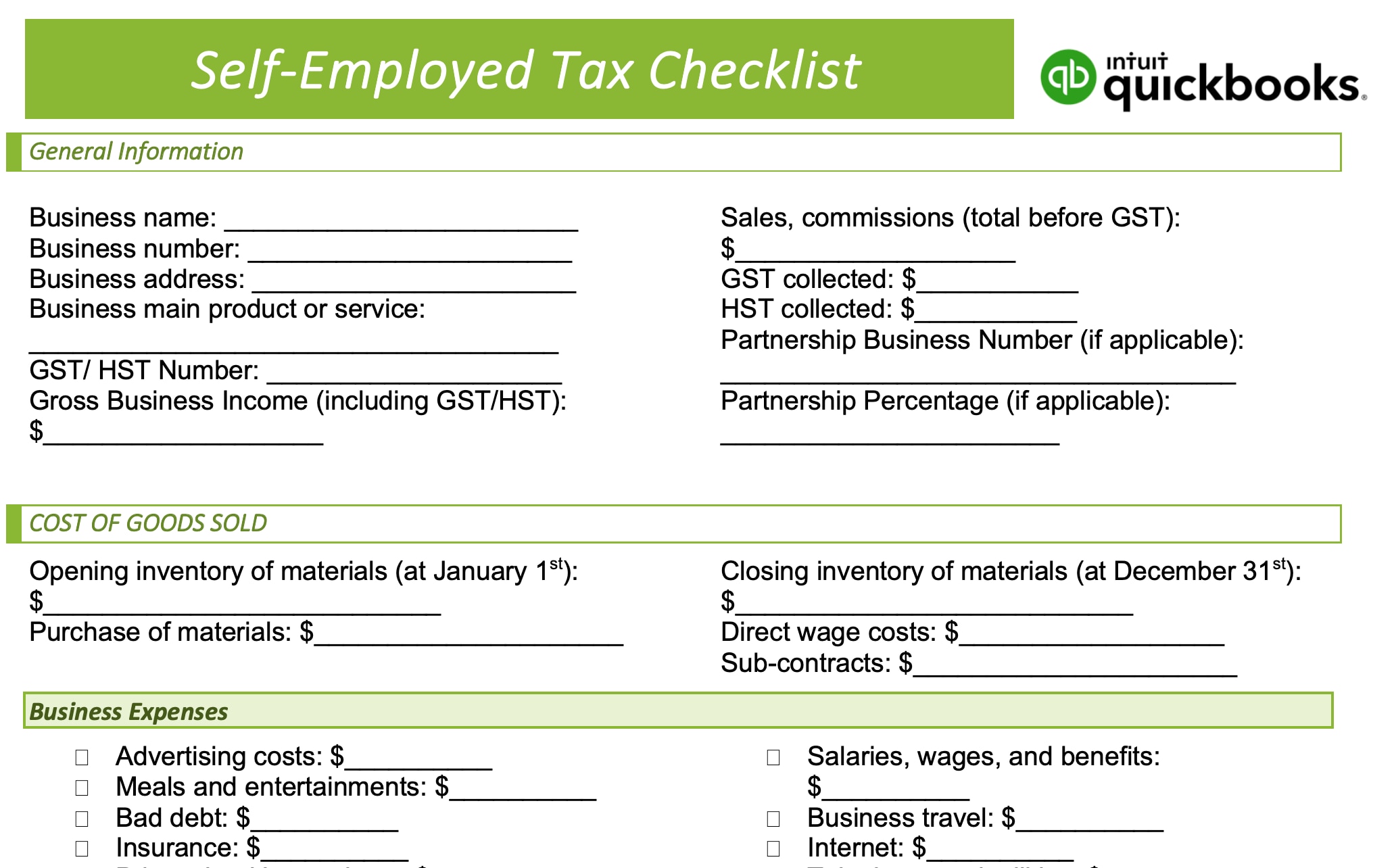

Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. Tax deduction records. The longer you go without filing taxes the higher the penalties and potential prison term.

The tax form you file is a Form W-2 and you file it on behalf of your employees. Select Next until you reach the End of Interview window and select Create State File. See IRSgov for details.

Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without. Offer may change or end at any time without notice. Among the most important things a CPA tax preparer or tax preparation software will need to file your tax return are the full names and Social Security numbers or tax identification numbers of you your spouse and your dependents.

TurboTax Free Edition 0 Federal 0 State 0 To File is available for simple tax returns only see if you qualify and has limited functionality. How to File a Quit Claim Deed in Florida. Filing your taxes with the Canada Revenue Agency for employed individuals is pretty straightforward.

Answer the questions and verify all info. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more.

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

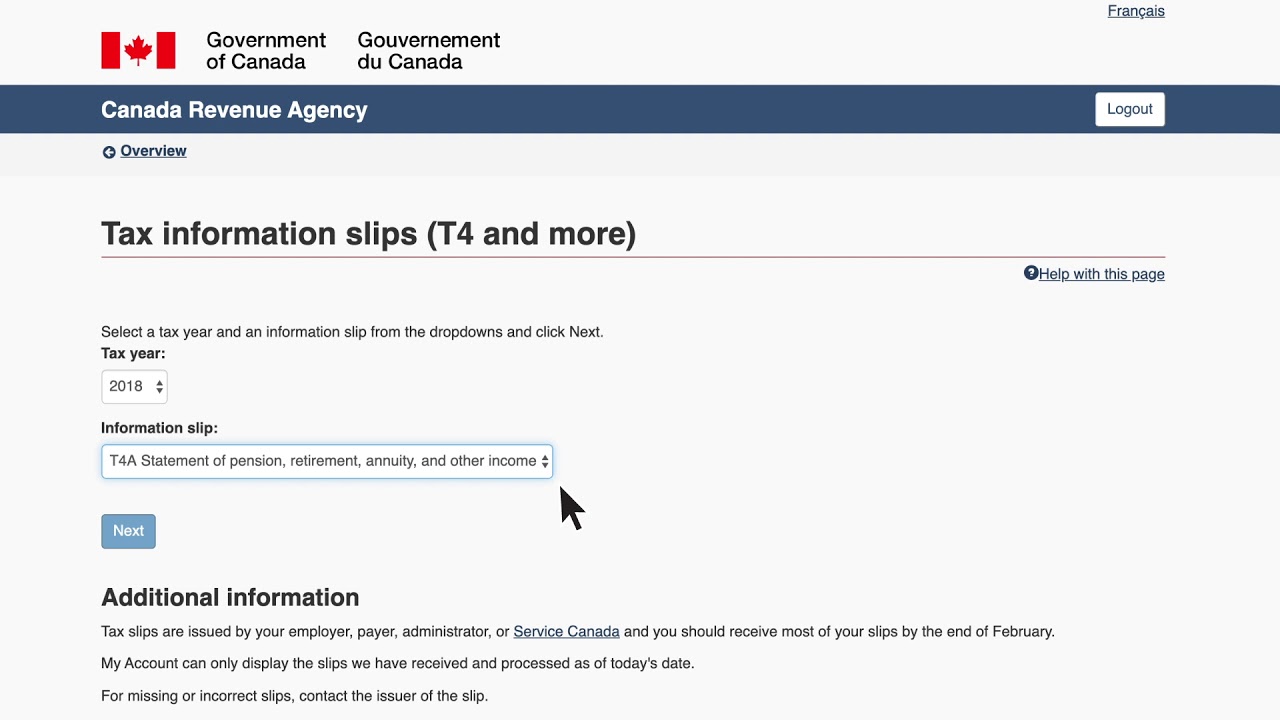

How To Request A T4 From Canada Revenue Agency 2022 Turbotax Canada Tips

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

Canadian Tax Requirements For Nonprofits Charitable Organizations

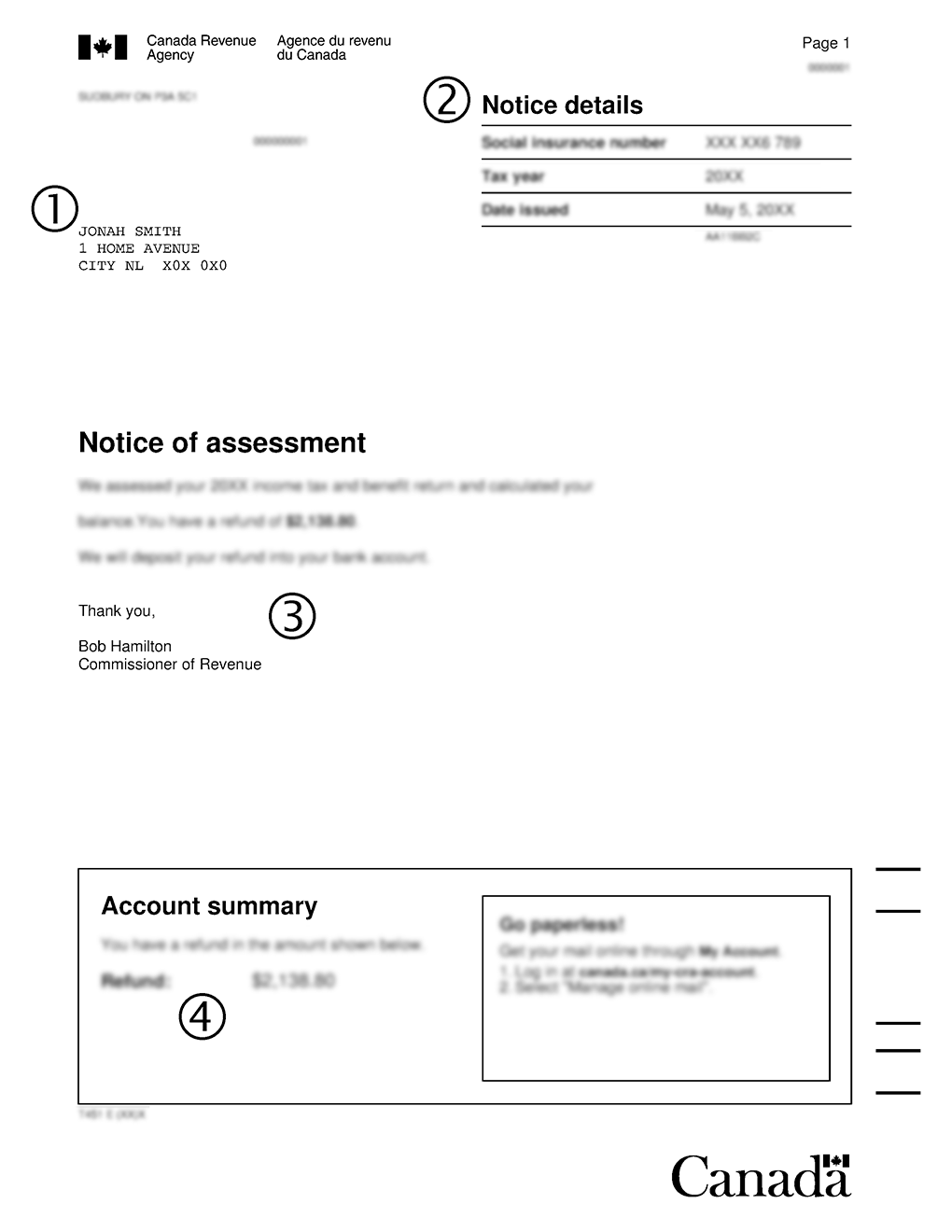

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

Income Tax Completion Services Fswe

How To Prepare And File Your Canadian Tax Return Dummies

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

How To File Self Employed Taxes In Canada Quickbooks Canada

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Notice Of Assessment Tax Form Federal Notice Of Assessment In Canada 2022 Turbotax Canada Tips

Notifying Canada Revenue Agency Cra Of A Change Of Address 2022 Turbotax Canada Tips

Completing A Basic Tax Return Learn About Your Taxes Canada Ca